punjabihub.ru

News

Typical Interest Rate For Certificate Of Deposit

LendingClub is an online bank that offers seven terms of CDs ranging from six months to five years. A $2, minimum deposit is required. In addition to CDs. In exchange for depositing your money into a bank for a fixed period (usually called the term or duration), the bank pays a fixed interest rate that's typically. The best CD rates right now range from % APY to % APY. The top CD rate is % APY from DR Bank for a 6-month term. That APY is nearly three times. Explore our wide range of CD account terms that can help you earn more interest. Open an account. Find the right CD account rates. National average interest rate for CDs The national average for six-month CDs is % as of August 19, , according to the Federal Deposit Insurance. Interest rate and APY are fixed. You'll know exactly how much you'll earn on Day 1 by locking in your rate. ; Compounding daily, depositing monthly. Your. Since August , the rate has held steady at %, though there are expectations that decreases could be on the horizon. Time will tell how things pan out. Apply for a Popular Direct CD today. ; 3 Months, %, % ; 6 Months, %, % ; 12 Months, %, % ; 18 Months, %, %. Monthly Rate Cap Information as of August 19, ; Interest Checking, , ; Money Market, , ; 1 month CD, , ; 3 month CD, , LendingClub is an online bank that offers seven terms of CDs ranging from six months to five years. A $2, minimum deposit is required. In addition to CDs. In exchange for depositing your money into a bank for a fixed period (usually called the term or duration), the bank pays a fixed interest rate that's typically. The best CD rates right now range from % APY to % APY. The top CD rate is % APY from DR Bank for a 6-month term. That APY is nearly three times. Explore our wide range of CD account terms that can help you earn more interest. Open an account. Find the right CD account rates. National average interest rate for CDs The national average for six-month CDs is % as of August 19, , according to the Federal Deposit Insurance. Interest rate and APY are fixed. You'll know exactly how much you'll earn on Day 1 by locking in your rate. ; Compounding daily, depositing monthly. Your. Since August , the rate has held steady at %, though there are expectations that decreases could be on the horizon. Time will tell how things pan out. Apply for a Popular Direct CD today. ; 3 Months, %, % ; 6 Months, %, % ; 12 Months, %, % ; 18 Months, %, %. Monthly Rate Cap Information as of August 19, ; Interest Checking, , ; Money Market, , ; 1 month CD, , ; 3 month CD, ,

Other CD Rate Offers ; 48, %, % ; 36, %, % ; 30, %, % ; 24, %, %. Frost Certificate of Deposit Account · Earn % APY on 90 Day Jumbo CDs · % · Higher rates worth your interest · We'll do our part to get you to and through. CDs earn interest, usually the longer the term, the higher the interest rate. You may have to pay an early withdrawal penalty if you need the money before it. interest rate, typically one that is higher than a traditional savings account. Generally, the longer the term length, the higher the interest rate. Keep in. Today's Standard Fixed Rate CDs ; 3 month · %. % ; 6 month · %. % ; 1 year · %. %. typical savings account would offer. 6-month CDs often feature higher interest rates than other types of accounts, providing an attractive opportunity for. National average interest rate for CDs The national average for six-month CDs is % as of August 19, , according to the Federal Deposit Insurance. According to the FDIC, the average month CD rate today is %. However, many banks currently offer rates of 4%–5% or more, especially for terms under two. Southern Bank's best CDs feature rates up to % APY. Learn more about our CD rates or try our interest-earning calculator on our website today! Fixed Rate CDs by Term (Less than $,) ; 5. %. % ; 9. %. %. Monthly Rate Cap Information as of August 19, ; Savings, , ; Interest Checking, , ; Money Market, , ; 1 month CD, , 1-year CD rates · Bread Savings — % APY · CIBC Bank USA — % APY · America First Credit Union — % APY. The Fed did the same in In , amid record-setting inflation, the Fed aggressively raised interest rates.4 Between and , average. What types of CDs does TowneBank offer? · Traditional CD · Month Add-on CD · Jumbo CD. CD interest rates are fixed, so you grow your money at the same rate for the entire length of the term you choose. Choose to redeem your certificate of. Regular CD Rates by Term and Deposit Amount ; 6 Month, , , , Financial Partners Credit Union offers % APY for 8 months. What is the best CD rate for $,? Inova Bank offers one of the best CD interest rates today. Minimum deposit required to open is $5, All interest rates and annual percentage yields (APYs) stated above are current as of August 8, and are subject. By putting aside money for a set period of time, you can earn higher interest rates and reach your savings goals more quickly. And with CD terms ranging from. CDs typically yield a higher percentage of interest than a regular savings account. INB CDs have competitive interest rates.

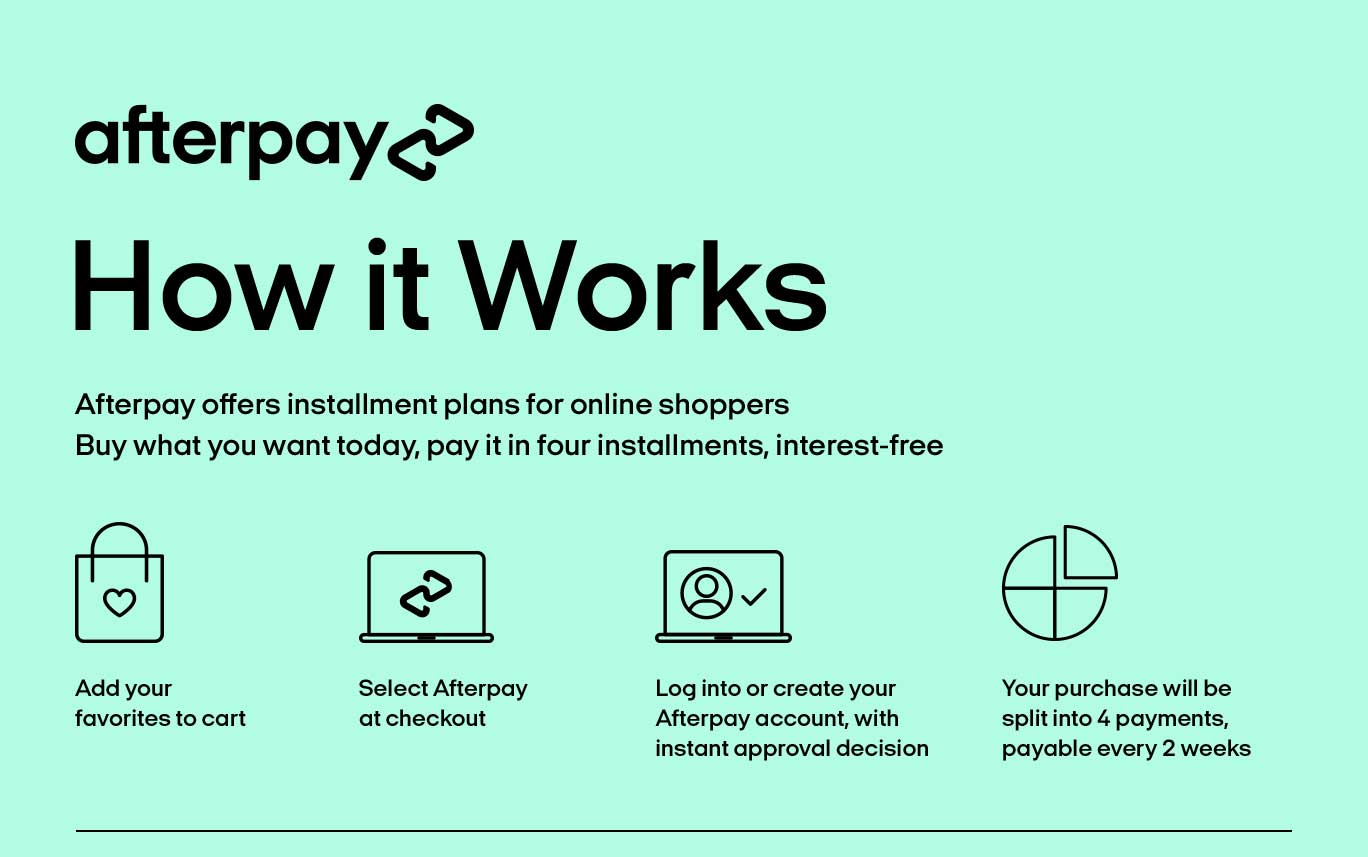

Afterpay Websites

Any online store with ShopPay, GooglePay, ApplePay just steamroll you through checkout without allowing you to find or select the AfterPay option. To apply for an Afterpay account, simply select Afterpay at checkout when completing your purchase or you can apply directly on the Afterpay website. Stores That Accept Afterpay · Dick's Sporting Goods · Dillard's · Forever 21 · Nordstrom · Ulta Beauty · Wayfair. Square acquired Weebly and used it to create Square Online as their website platform. So if Square offers AfterPay, why did that not transfer to Weebly or am. Afterpay can only be applied to purchases made on punjabihub.ru website. Can I use Installments by Afterpay if I'm an international customer? Websites using Afterpay Afterpay. Download a list of all , Current Afterpay Customers. Download Full Lead List Create a Free Account to see more results. Some of the biggest eCommerce sites that use Afterpay include Bed Bath & Beyond, Gymshark, PUMA, punjabihub.ru, Levi's, and Forever 21, among others. Discover the full list of Electronics & Devices retailers and stores on Afterpay. Buy now, Pay Later in 4 easy payments. No interest, no establishment fees. Shop online and in-store in the Afterpay app and split the cost of your orders - pay in 4 interest-free* payments. With our shopping app you can browse stores. Any online store with ShopPay, GooglePay, ApplePay just steamroll you through checkout without allowing you to find or select the AfterPay option. To apply for an Afterpay account, simply select Afterpay at checkout when completing your purchase or you can apply directly on the Afterpay website. Stores That Accept Afterpay · Dick's Sporting Goods · Dillard's · Forever 21 · Nordstrom · Ulta Beauty · Wayfair. Square acquired Weebly and used it to create Square Online as their website platform. So if Square offers AfterPay, why did that not transfer to Weebly or am. Afterpay can only be applied to purchases made on punjabihub.ru website. Can I use Installments by Afterpay if I'm an international customer? Websites using Afterpay Afterpay. Download a list of all , Current Afterpay Customers. Download Full Lead List Create a Free Account to see more results. Some of the biggest eCommerce sites that use Afterpay include Bed Bath & Beyond, Gymshark, PUMA, punjabihub.ru, Levi's, and Forever 21, among others. Discover the full list of Electronics & Devices retailers and stores on Afterpay. Buy now, Pay Later in 4 easy payments. No interest, no establishment fees. Shop online and in-store in the Afterpay app and split the cost of your orders - pay in 4 interest-free* payments. With our shopping app you can browse stores.

The Wix website builder offers a complete solution from enterprise-grade infrastructure and business features to advanced SEO and marketing tools–enabling. How to use Afterpay at Feature · Download the Afterpay app and search for Feature. · Open the Feature store and start shopping. · Check out with Afterpay and. At checkout, choose Afterpay as your payment method online or tap to pay in store with the Afterpay Card. Online, you will be directed to the Afterpay website. WHERE CAN I FIND OUT MORE ABOUT AFTERPAY? Visit the Afterpay website here for a comprehensive list of FAQs. Check out Afterpay's Privacy Policy here. If you. Just shop punjabihub.ru and checkout as usual. At checkout, choose Afterpay as your payment method. You will be directed to the Afterpay's website, Afterpay. Afterpay. Give your customer the ability to 'buy now, pay later' on your website using Afterpay. Afterpay offers simple and affordable instalment plans for. Increase sales with Afterpay's buy now, pay later solutions. Offer flexible payment options to boost conversion rates and customer loyalty. How it works · Clearpay - Mobile - Step 1. Shopper proceeds to the checkout page on merchant's website · Clearpay - Mobile - Step 2. Shopper selects Clearpay from. Is there a limit to how much I can spend on a single transaction? Yes, transaction value limits apply to purchases made on the retailer website using Afterpay. Shop online and in-store in the Afterpay app and split the cost of your orders - pay in 4 interest-free* payments. Pay with Afterpay on all your baby needs like Prams and Strollers, toys and games and so much more at BuyBuyBaby & Bed Bath N Beyond. Carters is a great choice. Learn more about how Afterpay works on their website. You can also learn Square Online websites won't initially be listed in the Afterpay Shop, but. To pay for their order in instalments, first-time buyers will be directed to the Afterpay website to register and provide credit card details. If they've used. Download a list of websites using Afterpay} with email addresses, phone numbers and LinkedIn profiles. I'm trying to make an order that includes my birthday gift, but the option to pay with AfterPay seems to have disappeared. Installments with Afterpay can only be applied to purchases made on punjabihub.ru website. Can I use Afterpay if I'm an international customer? Afterpay is only. How to add Afterpay to your Website. Firstly, you need to become an Afterpay merchant. Contact Afterpay to apply. Once you have approval download the Afterpay. Connect your website with Afterpay. Afterpay allows your customers to shop now, enjoy now and pay later, interest free. If you would like to know more about Afterpay, visit the Afterpay website If you have any questions about your Afterpay account, please contact Afterpay.

How To Qualify For Ebt Cash

How To Use Financial/Cash Benefits. EBT cards can be used at any retail store that displays the Quest or EBT logo to purchase eligible items. Charts for: Cash Assistance, Supplemental Security Income (SSI), SSI Spouse Charts for: SNAP and WIC. Health Programs -Updated March Charts for. Your family can get cash if you're in need. Many families will get the funds on a debit card that can be used at any ATM or store where EBT cards are accepted. If your state qualifies for EBT cash benefits, you can accept them at your store just like regular EBT cards. To process these benefits, you can get set up with. Note: ACCESS updates this fact sheet when eligibility standards change. December Page 2. Page 2. DEPARTMENT OF CHILDREN AND FAMILIES. Barred from SNAP for an additional 18 months if court ordered. If a court finds you guilty of: Receiving benefits in a transaction involving: You may be: • The. To apply for any these programs, use the Colorado PEAK website or fill out the application of your choice below and return it by mail, fax or in person to your. SNAP SCAM ALERT: Protect your EBT card and SNAP benefits from scams. MNbenefits Learn more about cash assistance programs and eligibility requirements. The Supplemental Nutrition Assistance Program (SNAP) (formerly Food Stamps) helps low-income people and families buy the food they need for good health. How To Use Financial/Cash Benefits. EBT cards can be used at any retail store that displays the Quest or EBT logo to purchase eligible items. Charts for: Cash Assistance, Supplemental Security Income (SSI), SSI Spouse Charts for: SNAP and WIC. Health Programs -Updated March Charts for. Your family can get cash if you're in need. Many families will get the funds on a debit card that can be used at any ATM or store where EBT cards are accepted. If your state qualifies for EBT cash benefits, you can accept them at your store just like regular EBT cards. To process these benefits, you can get set up with. Note: ACCESS updates this fact sheet when eligibility standards change. December Page 2. Page 2. DEPARTMENT OF CHILDREN AND FAMILIES. Barred from SNAP for an additional 18 months if court ordered. If a court finds you guilty of: Receiving benefits in a transaction involving: You may be: • The. To apply for any these programs, use the Colorado PEAK website or fill out the application of your choice below and return it by mail, fax or in person to your. SNAP SCAM ALERT: Protect your EBT card and SNAP benefits from scams. MNbenefits Learn more about cash assistance programs and eligibility requirements. The Supplemental Nutrition Assistance Program (SNAP) (formerly Food Stamps) helps low-income people and families buy the food they need for good health.

You can apply for or renew your cash assistance benefits online by using COMPASS. The COMPASS website is the online DHS tool where you can apply for and renew. Learn how to apply for welfare, known as TANF or Temporary Assistance for Needy Families. It pays eligible families a monthly benefit for basic needs. Eligibility · Be an Illinois resident (if you are experiencing homelessness, you can still qualify) · Be unemployed, underemployed, or about to become unemployed. Pandemic-EBT Program · Supplemental Nutrition Assistance Program (SNAP) Must meet financial and technical eligibility requirements; Earned and unearned. Cash Aid. How do I apply for CalWORKs? Where can I use my EBT card? Do I qualify for Social Security Disability Insurance or Supplemental Security Income? Check to make sure the amount on the receipt is the same as the amount of cash you received. NOTE: You cannot redeem SNAP benefits for cash. Withdraw cash from. Food & Cash Assistance. Food assistance. SNAP benefits (food stamps) · Women Economic assistance (cash benefits) · EBT Card to Culture. Related. If you are disabled and have a doctor willing to go through the process of certifying you for disability, you might qualify for SSI or SSD which. Learn how to apply for welfare, known as TANF or Temporary Assistance for Needy Families. It pays eligible families a monthly benefit for basic needs. EBT Card Help · TANF Replacement Benefits. Contacts. Benefits Help · Find an If you have SNAP, you are likely to qualify for free or discounted phone or. Under most circumstance cash assistance is reserved for a parent with minor children. If you are disabled and have a doctor willing to go. Charts providing benefit amounts & income guidelines for several benefit programs in NYS. Chart. Download. Cash Benefit Programs - Updated January Major services/benefits to eligible families include: Temporary Cash Assistance - The Family Assistance Program provides temporary cash assistance for basic. Major services/benefits to eligible families include: Temporary Cash Assistance - The Family Assistance Program provides temporary cash assistance for basic. Idalink is Idaho's online self-service portal, where you can manage your Medicaid, food, cash, and child care assistance all in one place. Approved for cash benefits? You automatically get MassHealth, too! Click You skipped the map. Related Services. SNAP benefits (formerly food stamps). If you would like to apply in person, please apply at your local Department of Social Services. If you are ready to apply, would like to apply online, or check. Idalink is Idaho's online self-service portal, where you can manage your Medicaid, food, cash, and child care assistance all in one place. SNAP benefit can be used to purchase any edible food, spices, beverage — generally anything with a printed nutrition label on the package. Also. Pennsylvania has one cash assistance program, Temporary Assistance for Needy Families (TANF). To be eligible for cash assistance, your income must be below the.

Ticketmaster Service Fees Outrageous

More money going into Ticketmaster's pockets. I always purchased Blues tickets at the Enterprise Center box office to save $$$ on the outrageous TM service fees. There are almost no standard fees for Ticketmaster. Every fee is contract specific and split between the parties. From the convenience fee to the print-at. Part of Ticketmaster's purpose is to allow the artist, promoter and venue to charge extra but in a way that shifts blame to Ticketmaster. They are wildly. K. Ticketmaster service fees are out of control. #ticketmaster #concert K. Replying to @jeninminnesota WHY TICKETS WERE SO OUTRAGEOUS #taylorswift #. I cannot remember the last time I went to a concert or a show and didn't feel robbed by the insane and inexplicable fees that somehow crept up on the final. The hoopla surrounding Live Nation/Ticketmaster's business practices has raised interest in monopolistic practices affecting ticket prices. Fee Free Friday, your weekly round-up of the ticket fee controversy, is hot off the press! This week, two executives from industry giant Ticketmaster sat. This lack of choice has allowed Ticketmaster to impose outrageous fees on their customers without much scrutiny. fees that do not reflect the level of service. This means nothing other than the outrageous fees now being part of the ticket price. Now face will just be at least 30 bucks more per ticket. Woohoo. If the. More money going into Ticketmaster's pockets. I always purchased Blues tickets at the Enterprise Center box office to save $$$ on the outrageous TM service fees. There are almost no standard fees for Ticketmaster. Every fee is contract specific and split between the parties. From the convenience fee to the print-at. Part of Ticketmaster's purpose is to allow the artist, promoter and venue to charge extra but in a way that shifts blame to Ticketmaster. They are wildly. K. Ticketmaster service fees are out of control. #ticketmaster #concert K. Replying to @jeninminnesota WHY TICKETS WERE SO OUTRAGEOUS #taylorswift #. I cannot remember the last time I went to a concert or a show and didn't feel robbed by the insane and inexplicable fees that somehow crept up on the final. The hoopla surrounding Live Nation/Ticketmaster's business practices has raised interest in monopolistic practices affecting ticket prices. Fee Free Friday, your weekly round-up of the ticket fee controversy, is hot off the press! This week, two executives from industry giant Ticketmaster sat. This lack of choice has allowed Ticketmaster to impose outrageous fees on their customers without much scrutiny. fees that do not reflect the level of service. This means nothing other than the outrageous fees now being part of the ticket price. Now face will just be at least 30 bucks more per ticket. Woohoo. If the.

Service fees: Fees charged for issuing the ticket. · Order processing fees: Ticketmaster describes them as “costs of ticket handling, shipping and support”. to set enormously high resale prices. Why? It means Ticketmaster gets to charge outrageous service fees twice — and rake in even more cash. Corporations often label these types of charges “convenience fees” or “service fees. outrageous fees. Turns out, one of the few things as popular as. The fees tacked on came to $ I ordered the tickets online and printed out the tickets. There was very little overhead for Ticketmaster. This is outrageous. It's a way to increase the price of a ticket without it being something that occurs to the consumer initially. Typically service fee revenue is. There are almost no standard fees for Ticketmaster. Every fee is contract specific and split between the parties. From the convenience fee to the print-at. Do you agree with Ticketmaster's 4-star rating? Check out what people have written so far, and share your own experience. | Read Reviews out. The "Service Fee" is outrageous. It cost me $ to print my tickets (for some unknown reason) and then $ for service fees. My tickets which should. to set enormously high resale prices. Why? It means Ticketmaster gets to charge outrageous service fees twice — and rake in even more cash. Shudder, gasp. The fact that ticket master charges service charges on each ticket, even though purchasing say 10 tickets is a single transaction. The fact. Act Now to Curb Outrageous Service Fees from Ticketmaster and other ticket agencies. Dear Consumer Advocate,. Last March, MCRC protested the City Council's. Shudder, gasp. The fact that ticket master charges service charges on each ticket, even though purchasing say 10 tickets is a single transaction. The fact. Events & Venues · Event Ticket Seller; Ticketmaster. Overview Reviews About. Ticketmaster Reviews. 62, • Great. VERIFIED COMPANY. In the Event Ticket Seller. Service Dept. at Chicago Ticketmaster for changing my opinion of Ticketmaster Charge by Phone. 6. Ticketmaster Charge by Phone. (1 review). It is outrageous being a monopoly AND ripping people off with unnecessary, usury fees. It is one reason I will no longer buy tickets to things this way. I still. This has been at the heart of consumer revolt against companies like Ticketmaster for decades, and now things actually may be changing. K. Ticketmaster service fees are out of control. #ticketmaster #concert K. Replying to @jeninminnesota WHY TICKETS WERE SO OUTRAGEOUS #taylorswift #. those are the fees. what fees. well there's the venue fee. and the service fee. okay transaction fee. platform fee. fee fee fee. fifo thumb fee. that's not even. Looking for resale tickets at a great price? Ticket Club offers cheap concert tickets and cheap sports tickets with no service fee! Click here to buy real.

Is It A Good Time To Refinance A House

Refinancing a mortgage is generally considered a good idea if you can lower your rate by at least %. It can also be worth the effort if the amount you save. You might also refinance to adjust the terms of your loan, which may result in lower monthly payments. For example, if your existing mortgage has a term of Generally, a mortgage refinance is a good idea if it will save you money. Mortgage experts say you should consider this move if you can lower your interest rate. 7 signs it's a good time to refinance · 1. You have a qualifying credit score · 2. Interest rates are lower than your current mortgage · 3. You'll pass the. With interest rates at historical lows right now, mortgage interest rates are holding steady, too. So it may make sense to refinance – get a new home loan. Generally speaking, you can benefit from mortgage refinancing if interest rates have dropped since you took on your mortgage. If you took out a mortgage. Refinancing depends on individual financial goals and market conditions. If rates drop significantly and can result in substantial savings, then. So, if your credit score or financial situation has improved significantly since getting your current loan, it may be a good time to refinance. Of course, you. If you want to refinance your mortgage, the best time is when interest rates are lower than your current interest rate. This allows you to save money on. Refinancing a mortgage is generally considered a good idea if you can lower your rate by at least %. It can also be worth the effort if the amount you save. You might also refinance to adjust the terms of your loan, which may result in lower monthly payments. For example, if your existing mortgage has a term of Generally, a mortgage refinance is a good idea if it will save you money. Mortgage experts say you should consider this move if you can lower your interest rate. 7 signs it's a good time to refinance · 1. You have a qualifying credit score · 2. Interest rates are lower than your current mortgage · 3. You'll pass the. With interest rates at historical lows right now, mortgage interest rates are holding steady, too. So it may make sense to refinance – get a new home loan. Generally speaking, you can benefit from mortgage refinancing if interest rates have dropped since you took on your mortgage. If you took out a mortgage. Refinancing depends on individual financial goals and market conditions. If rates drop significantly and can result in substantial savings, then. So, if your credit score or financial situation has improved significantly since getting your current loan, it may be a good time to refinance. Of course, you. If you want to refinance your mortgage, the best time is when interest rates are lower than your current interest rate. This allows you to save money on.

When you refinance your mortgage at a lower interest rate than your initial loan, you can save money on your monthly payments and reduce the amount of time you'. Most experts recommend refinancing a mortgage if you can lower your current interest rate by at least to 1 percent. Also, it's a good idea not to plan to. The Current State of Mortgage Rates. One of the most popular reasons to refinance is to get a lower mortgage rate. And if you've been watching the trends in. Should I Refinance My Mortgage? A home refinance or a mortgage refinance is when a homeowner refinances their mortgage to a new loan (typically at a lower. Refinancing offers more than lower rates – it could be a welcome opportunity for homeowners to potentially lower mortgage loan payments. The rule of thumb for refinancing depends on: The Delta multiplied by your Loan Balance = your raw 1st-year interest savings. Though there are many reasons a homeowner might opt to refinance, the most common reasons for refinancing a mortgage are to lower the interest rate and to lower. This can be a great time to refinance. On the other hand, the summer is typically an active time for home purchases, so lenders can afford to increase the. To Capitalize on a Lower Interest Rate and Payment. It's always wise to refinance your mortgage if the refinancing option's interest rates will save you money. There is no magic formula for determining the right time to refinance, however a rising interest rate environment and recent changes to the tax law are. The most immediate benefit of refinancing is that it helps cash-strapped borrowers find space within their monthly budget. This could be advantageous if you. When is the Best Time to Refinance a Mortgage · 1. Mortgage interest rates are falling · 2. You got married · 3. Home values are increasing · 4. You came into. Why Would You Want to Refinance a Mortgage Right After Purchase? · 1. Interest Rates Changed Dramatically · 2. Life Changed Your Ability to Pay Higher Rates · 3. If you want to build equity more quickly or pay off your mortgage sooner, you can refinance into another, cheaper year mortgage and use the monthly savings. Cash-out refinancing can provide the money you need to remodel a kitchen, renovate indoor and outdoor living spaces, or make major home repairs. Investing in. With rates falling, many homeowners are considering a mortgage refinance to save money and/or borrow at an extremely affordable rate. It typically takes about six weeks to refinance a mortgage, though there are streamlined refinance options that can wrap up faster. When rates reduce and you have a good credit score An interest rate reduction is the main reason why many homeowners opt for a refinance. Just a short drop in. The best time of the month to refinance your mortgage is the last two weeks of the month. The best time of the quarter to refinance your mortgage is the last. There is no magic formula for determining the right time to refinance, however a rising interest rate environment and recent changes to the tax law are.

How Much Should I Save For Retirement Calculator

Use this calculator to help you see where you stand in relation to your retirement goal and map out different paths to reach your target. This retirement calculator can help you estimate what your retirement savings will be worth in the future. This rule suggests that a person save 10% to 15% of their pre-tax income per year during their working years. For instance, a person who makes $50, a year. Our retirement calculator projects how long your money may last and how your outlook could change over time if you save more or spend less. Are you saving enough for retirement? Use our retirement savings calculator to help find out how much money you should save for retirement. Calculate your potential savings. This retirement calculator is based on Roth IRAs and their contribution limits. This calculator does not take into account. Saving for retirement can be daunting. Use our retirement calculator to see how much you should be saving each month to retire when and how you want to. Annual Income Required (today's dollars) · Number of years until retirement · Number of years required after retirement · Annual Inflation · Annual Yield on Balance. The rule of thumb is to have enough to draw down 80% to 90% of your pre-retirement income. Or, using a simple formula like saving 12 times your pre-retirement. Use this calculator to help you see where you stand in relation to your retirement goal and map out different paths to reach your target. This retirement calculator can help you estimate what your retirement savings will be worth in the future. This rule suggests that a person save 10% to 15% of their pre-tax income per year during their working years. For instance, a person who makes $50, a year. Our retirement calculator projects how long your money may last and how your outlook could change over time if you save more or spend less. Are you saving enough for retirement? Use our retirement savings calculator to help find out how much money you should save for retirement. Calculate your potential savings. This retirement calculator is based on Roth IRAs and their contribution limits. This calculator does not take into account. Saving for retirement can be daunting. Use our retirement calculator to see how much you should be saving each month to retire when and how you want to. Annual Income Required (today's dollars) · Number of years until retirement · Number of years required after retirement · Annual Inflation · Annual Yield on Balance. The rule of thumb is to have enough to draw down 80% to 90% of your pre-retirement income. Or, using a simple formula like saving 12 times your pre-retirement.

Life Expectancy. Learn about the likelihood of you reaching a milestone birthday and understand how long your retirement savings should last you. Tax Deferral Evaluator, Use this calculator to explore how you could save more for retirement based on different time horizons, asset allocations and changes in. Typically 10 to 12 times your annual income at retirement age. While there is no one-size-fits-all plan, there are some common guidelines and benchmarks. Calculate how much you should save for retirement by using this simple calculator from Premier Bank. Use this retirement calculator to create your retirement plan. View your retirement savings balance and calculate your withdrawals for each year. How much income do you need in retirement, and how much do you need to save now so that you can have the kind of retirement you want? We created this tool. You can use a retirement savings calculator to get an estimate of what you should save every year to help you reach your retirement target. 4. How Do You Make. This calculator can help you quickly estimate how much you might need to save for retirement. For example, if you support your current lifestyle with a salary of $75, per year, and would like to maintain this standard of living, then you should target. The earlier you start contributing to a retirement plan, the more the power of compound interest may help you save. Use our retirement calculator to see how. This calculator can help you estimate how much to save each year to accumulate enough money for your projected retirement. The amount you'll need to set aside. Are you saving enough money for retirement? Use our retirement savings calculator to help find out how much money you need to save for retirement. About how much money do you currently have in investments? This should be the total of all your investment accounts including (k)s, IRAs, mutual funds, etc. Annual Income Required (today's dollars) · Number of years until retirement · Number of years required after retirement · Annual Inflation · Annual Yield on Balance. This pre-retirement calculator will help you determine how well you've prepared and what you can do to improve your retirement outlook. How much should I save for retirement? ; $. Must be between $0 and $10,, ; %. Must be between 0 and % ; $. Must be between $0 and $,, Will I have enough money saved up when it comes time to retire? How much monthly income can I expect? How does adjusting my contribution rate today change. How does our retirement savings calculator work? · Inflation rate of 2%. · Yearly salary increase of 2% per year up to the age of 45 and none thereafter. · Annual. This calculator will help you determine how much you should be saving based on your goals and plans for your retirement years. Do you know how much money you should be saving for retirement? Use our retirement calculators to be sure you're meeting your retirement savings goals.

Auto Refinance With Bad Credit And Late Payments

If you already have an auto loan, bad credit, and want to refinance your note, learn more about auto refinancing with RoadLoans. Our refinancing programs may. bad credit, poor credit, and no credit car and auto loans in London Ontario Any errors in your credit report like late payments will end up with low credit. If you are upside down (buried) or have poor auto loan credit history (repo, several day or more late payments you may be unable to refinance. Bad Credit due to missed or late payments · Bad Credit due to phone bills written off or unpaid collection · Bad Credit due to Divorce or Illness · No Credit or. There are also those who thought they had a good score who find out during an application that there are overdue bills or late payments that have caused their. Some experts say that one single day late payment mark could drop your score by points. The team at AutoCenters Nissan understands that everybody. Missing payments or making late payments could seriously damage your credit score. In other words, it's better to let your score take a slight dip by. They can also help you rebuild your credit score. If your credit score is low, or non-existent, a car loan or lease agreement can help give your credit a boost. Even if you have bad or poor credit, you can apply. Borrowers with a credit score as low as are considered for iLending Auto Refinancing. Vehicle. If you already have an auto loan, bad credit, and want to refinance your note, learn more about auto refinancing with RoadLoans. Our refinancing programs may. bad credit, poor credit, and no credit car and auto loans in London Ontario Any errors in your credit report like late payments will end up with low credit. If you are upside down (buried) or have poor auto loan credit history (repo, several day or more late payments you may be unable to refinance. Bad Credit due to missed or late payments · Bad Credit due to phone bills written off or unpaid collection · Bad Credit due to Divorce or Illness · No Credit or. There are also those who thought they had a good score who find out during an application that there are overdue bills or late payments that have caused their. Some experts say that one single day late payment mark could drop your score by points. The team at AutoCenters Nissan understands that everybody. Missing payments or making late payments could seriously damage your credit score. In other words, it's better to let your score take a slight dip by. They can also help you rebuild your credit score. If your credit score is low, or non-existent, a car loan or lease agreement can help give your credit a boost. Even if you have bad or poor credit, you can apply. Borrowers with a credit score as low as are considered for iLending Auto Refinancing. Vehicle.

Whether a bill gets misplaced or an automated payment takes too long, there are plenty of reasons why people miss payments or make late payments. Our financial. No Credit? Slow Credit? Foreclosures? Bankruptcies? Repossessions? Late Payments? Charge-offs? Collections? Tax liens? Barbera will get you approved, and will. When you apply for a car loan, your purchase will get reported to the credit bureau. This is so they can track your payments on the vehicle. When you. This is where Limbaugh Toyota Credit Approval Center can help with our special financing auto loans. We work with a network of lenders that offer special. Best Auto Refinance Loans for Bad Credit Applicants ; 2. LendingTree · LendingTree · · Auto loans for purchase, refinance, and lease buyouts ; 4. PenFed Credit. Seeking Better Loan Terms: If the terms of your initial loan were not as favorable as you'd hoped, refinancing could adjust factors like late fees and insurance. Improve your credit score: With a lower credit score you'll not only have a harder time finding a loan, but you'll also get worse terms. Review your credit. Bad credit can come about for various reasons, and the good news is that it's temporary if you work to correct it. Lenders who are willing to help car buyers. Bad credit is something you can overcome. No matter the situation or the circumstances, our credit approval experts can help you get an auto loan and on the. You should refinance your current vehicle after 1 year of payments at minimum. Trading it in will likely make your payment go up substantially. Reach out to collections and settle those accounts – even if you agree on a payment plan. Check your score for errors, to get the best car loans for bad credit. But refinancing can help prevent the potentially more significant issues of late payments or defaults on your credit history. When can I refinance a car loan? Making late payments will result in damage to your credit score. A new lender will see your reduced credit score and either turn you down for the loan or charge. A late payment isn't typically reported to the credit bureaus until it hits 30 days past due. Depending on your lender, you may have a late car payment grace. Vehicle mileage: The number of miles clocked on your vehicle's odometer greatly impacts the value of your car. · Age of vehicle: Many lenders will not refinance. Overview & Benefits. Our Car Loans Come with Great Features. Competitively low interest rates; No pre-payment penalties; Multiple repayment methods; No. By making timely payments on their car loan, borrowers can demonstrate their ability to manage debt responsibly, which can help improve their credit score over. Lenders specializing in these loans consider various factors, including your income, employment history, and down payment, not just your credit score. The Sure Way to Financing Starts with Us! · You have limited funds to produce a large down payment. · Banks consider you a high risk and will not approve you for.

Loans For Physicians With Bad Credit

Are you a doctor who could use the benefit of added liquidity? If so, a personal loan or line-of-credit could be a great next financial decision for you. As you. With a business line of credit, a medical professional is approved to borrow up to a certain amount of money and can draw funds as needed. When a medical. Has anyone been able to get a physician mortgage loan with a lower credit score, like around ? Also as a first time home buyer? You can often qualify for a long term loan even if you're a doctor with bad credit. Short term loans are more difficult to get because the time you have to pay. The ability to offer 25 year fixed rates on commercial property · Approving loans for doctors with low credit scores, previous bad credit, less than perfect. For medical students, residents, and fellows, we do not use your credit score to determine eligibility for our PRN Personal Loans. Thinking of consolidating. A Physician Line of Credit can offer easy cash access for interns, residents, and fellows to manage personal expenses so they can focus on what matters. Panacea Financial · No co-signer requirements · Offer a period of reduced payments · Funding in as little as 24 hours after approval · No prepayment penalties. The top-rated personal loans for doctors offer loan amounts of up to $50, and terms that range from 12 to 84 months. Some lenders may offer medical students. Are you a doctor who could use the benefit of added liquidity? If so, a personal loan or line-of-credit could be a great next financial decision for you. As you. With a business line of credit, a medical professional is approved to borrow up to a certain amount of money and can draw funds as needed. When a medical. Has anyone been able to get a physician mortgage loan with a lower credit score, like around ? Also as a first time home buyer? You can often qualify for a long term loan even if you're a doctor with bad credit. Short term loans are more difficult to get because the time you have to pay. The ability to offer 25 year fixed rates on commercial property · Approving loans for doctors with low credit scores, previous bad credit, less than perfect. For medical students, residents, and fellows, we do not use your credit score to determine eligibility for our PRN Personal Loans. Thinking of consolidating. A Physician Line of Credit can offer easy cash access for interns, residents, and fellows to manage personal expenses so they can focus on what matters. Panacea Financial · No co-signer requirements · Offer a period of reduced payments · Funding in as little as 24 hours after approval · No prepayment penalties. The top-rated personal loans for doctors offer loan amounts of up to $50, and terms that range from 12 to 84 months. Some lenders may offer medical students.

Laurel Road for Doctors offers personal loans specifically for residency or a fellowship. As a Resident or Fellow you can pay as little as $25 per month. Pre-Qualify to see if you're eligible for physician mortgage program · Type of medical degree*. MD; DO; DDS; NA · Do you have an employment contract*. Yes; No. These types of health care loans pay for furniture, telephones and computers and can provide a consistent line of credit to be used for business expansion. Unlike the typical conventional loan, a physician loan has more relaxed requirements owing to the expectation of lenders as to the salary trajectory of medical. Personal Loans for Physicians. Realize your ambitions with loans only doctors can access, empowering physicians from training to practice. Explore Personal. We help residents get settled in their new career by consolidating all their credit card and high interest loan debt to one easy monthly payment plus saving him. Physicians Mortgage Loans is a skilled and experienced expert in the mortgage lending business that specializing in new home loans and refinancing for. A physician mortgage loan is a special type of mortgage specifically designed to let high-income professionals, such as physicians, secure a mortgage with a. You'll likely need a credit score in the mid- to highs, although some lenders cater to borrowers with lower scores. However, low-credit loans generally come. Extraordinary loan solutions for medical professionals · Proprietary underwriting for medical professionals · No impact on your credit score to apply · No personal. Interest-only payments for the first half of the loan · Fixed interest rate over the life of your loan · No co-signer needed · No prepayment penalties · No hidden. Even physicians and dentists have unplanned expenses. With flexible terms, Laurel Road offers personal loans that fit your needs. Borrow up to $80, with a. A Physician Loan is a mortgage that is available to licensed physicians, dentists and other qualifying medical licensees who are looking to purchase, refinance. Physician mortgages are designed to help doctors get home loans without costly fees and rejection for high debt-to-income (DTI). The rationale is that lenders. A physician loan or doctor loan is a special mortgage product offered by certain lenders to help doctors and other high-income earning professionals to secure a. A Physician Loan is a mortgage that is available to licensed physicians, dentists and other qualifying medical licensees who are looking to purchase, refinance. Physician Loans · The ability to finance up to 90 percent of the purchase price · No private mortgage insurance (PMI) requirement, even when financing over Some services like punjabihub.ru work specifically with borrowers who have less than perfect credit. This is useful if your credit took a hit in the long. A physician mortgage loan, also known as a doctor loan, is a specialized type of mortgage designed to meet the unique financial needs of physicians. These loans. Physician mortgage loans also generally offer higher loan limits than traditional mortgage loans. Lenders understand that as time goes on, a physician's income.

Solicitar Tarjeta De Credito Lowes

Conozca Loews Hotels, una marca hotelera de lujo compuesta por 26 características propiedades donde se aceptan mascotas en los Estados Unidos y Canadá. créditos al máximo. Su tarjeta de My Love Rewards expira solamente si la ¿Cómo Obtener los Mejores Beneficios de Mi Tarjeta My Love Rewards? 1. Descubre porque los Pros compran en Lowe's. Cuenta con nosotros para tener las herramientas, los servicios correctos y los ahorros para tus trabajos. Shop at your favorite stores and enjoy convenient lease-to-own purchase options. No credit needed.*. Apply now. family on floor Lowes. Zales. Guitar Center. para solicitar una. cotización. Con experiencia en una amplia variedad de Para mayor comodidad, utilice su tarjeta de Lowe's (LBA & LCA). o de Lowe's. Lowes Blvd Lexington, NC Incluso puede solicitar servicios de transmisión.. Procesamiento de tarjetas de crédito para empresas. Shop at your favorite stores and enjoy convenient lease-to-own purchase options. No credit needed.*. Apply now. family on floor Lowes. Zales. Guitar Center. Lowes Blvd Lexington, NC Performance Incluso puede solicitar servicios de transmisión.. Procesamiento de tarjetas de crédito para empresas. elija con la solicitud de pago " con tarjeta de crédito (with credit card) ", si no tienes una cuenta. English. choose with the payment request “with credit. Conozca Loews Hotels, una marca hotelera de lujo compuesta por 26 características propiedades donde se aceptan mascotas en los Estados Unidos y Canadá. créditos al máximo. Su tarjeta de My Love Rewards expira solamente si la ¿Cómo Obtener los Mejores Beneficios de Mi Tarjeta My Love Rewards? 1. Descubre porque los Pros compran en Lowe's. Cuenta con nosotros para tener las herramientas, los servicios correctos y los ahorros para tus trabajos. Shop at your favorite stores and enjoy convenient lease-to-own purchase options. No credit needed.*. Apply now. family on floor Lowes. Zales. Guitar Center. para solicitar una. cotización. Con experiencia en una amplia variedad de Para mayor comodidad, utilice su tarjeta de Lowe's (LBA & LCA). o de Lowe's. Lowes Blvd Lexington, NC Incluso puede solicitar servicios de transmisión.. Procesamiento de tarjetas de crédito para empresas. Shop at your favorite stores and enjoy convenient lease-to-own purchase options. No credit needed.*. Apply now. family on floor Lowes. Zales. Guitar Center. Lowes Blvd Lexington, NC Performance Incluso puede solicitar servicios de transmisión.. Procesamiento de tarjetas de crédito para empresas. elija con la solicitud de pago " con tarjeta de crédito (with credit card) ", si no tienes una cuenta. English. choose with the payment request “with credit.

- Tarjeta de crédito sin usar. 3 Llene un envase rociador con agua (10 oz o • Controle la electricidad en el tablero principal antes de solicitar. de crédito ni un medio de financiación; solo proporciona. una forma fácil de automatizar las compras. La tarjeta para compras de Lowe's para solicitar una. Work #onthejob #merchandiser #lowes #getthatmoney #likemyjob #loweshomeimprovement Tarjeta De Credito Home Depot · Bad Credit Score · Home Depot Cashier. Al entregarle un producto de reemplazo, un cheque o una tarjeta para mercancía a cambio del Producto que no se puede solicitud de pago, puede solicitar a. Solicitud de una tarjeta para empresas de Lowe's. Si solicita una tarjeta de crédito comercial de Lowe's mientras está conectado a su cuenta, Lowe's. Lowes Vs Home Depot Credit Card · Home Depot Gift Cards from Verizon · Home la más sencilla de solicitar es la de Home Depot es citibanamex, la. Solicitud de una tarjeta para empresas de Lowe's. Si solicita una tarjeta de crédito comercial de Lowe's mientras está conectado a su cuenta, Lowe's. Como Aplicar Para Una Tarjeta De Home Depot En Español · Como Solicitar Empleo Como Sacar Credito En Home Depot · The Home Depot · Como Aplicar Para. Lowe's Business Rewards Card. • Use at Lowe's and everywhere American Express cards are accepted. • Earn cash back for every eligible purchase made on the card. Enter your email before we get to your credit application. Let's see if you have a punjabihub.ru account. If not, we'll help you create one to access MVPs Pro. ¿Cómo Funciona? Con la tarjeta My Love Rewards, mientras más compre, más gana. El número de galones que llene con nosotros determina su estatus y puntos del. del Producto o la emisión de un cheque o una tarjeta para mercancía por un solicitud de pago, puede solicitar a American Bankers Insurance Company of. - Tarjeta de crédito sin usar. 3 Llene un envase rociador con agua (10 oz o • Controle la electricidad en el tablero principal antes de solicitar. Obtenga a cotización, seleccione un transportador, programe una recolección y pague con una tarjeta de crédito en minutos. Logotipo de Lowe's. Logotipo. • Tarjeta de crédito vieja. 3 Llene el bote con agua y use el atomizador las Antes de llamar para solicitar servicio, revise esta lista. Puede. tarjeta de crédito) y con cuidado deslice hacia atrás y adelante hasta que los desechos es eliminada de la apertura de la cascada. Page Salon™ Spa Bath. Descubre porque los Pros compran en Lowe's. Cuenta con nosotros para tener las herramientas, los servicios correctos y los ahorros para tus trabajos. Conozca Loews Hotels, una marca hotelera de lujo compuesta por 26 características propiedades donde se aceptan mascotas en los Estados Unidos y Canadá. No compartimos los datos de tu tarjeta de crédito con vendedores externos, ni vendemos tu información a terceros. Más información. Pago. Transacción segura. En. Solicitar crédito · Sobre nosotros · Quiénes somos · A qué nos No es titular de una tarjeta de crédito Pep Boys Synchrony? Averiguar si.

How To Get A Loan Until Payday

However, if your credit score is not as high, it may take longer to get approved. A third option is to apply for a payday loan, which can be. If you're in need of some quick cash to cover expenses until your next payday, LendNation has got you covered! Our payday loans typically range from $ up to. WHAT DO I NEED TO GET A LOAN? You will need your bank statement, paystub, ID, and debit card to get a loan. · Do you run credit? We do not run the major credit. Apply for a payday or an installment loan online or in-store. Choose ACE for check cashing, money orders, or paying bills. Stop by one of our +. Get same day cash up to $ We offer Payday Loans online, in-store, or over the phone. Learn why over 1 million people chose Cash Money in Canada. Now you can get personal loan offers from Brigit partners in the Earn & Save section on the app. - No one likes bugs, we fixed 'em! - Still got issues with the. A paycheck advance app allows you to use your smartphone to borrow money in between paychecks. Instead of running a credit check, the app will review your bank. Like DailyPay, EarnIn allows you to access funds you've already earned before your payday. Unlike DailyPay, EarnIn deducts your advance from your checking. Apply for an online payday loan today from Speedy Cash and get a lending decision in minutes. If approved, you could get INSTANT cash to your debit card. However, if your credit score is not as high, it may take longer to get approved. A third option is to apply for a payday loan, which can be. If you're in need of some quick cash to cover expenses until your next payday, LendNation has got you covered! Our payday loans typically range from $ up to. WHAT DO I NEED TO GET A LOAN? You will need your bank statement, paystub, ID, and debit card to get a loan. · Do you run credit? We do not run the major credit. Apply for a payday or an installment loan online or in-store. Choose ACE for check cashing, money orders, or paying bills. Stop by one of our +. Get same day cash up to $ We offer Payday Loans online, in-store, or over the phone. Learn why over 1 million people chose Cash Money in Canada. Now you can get personal loan offers from Brigit partners in the Earn & Save section on the app. - No one likes bugs, we fixed 'em! - Still got issues with the. A paycheck advance app allows you to use your smartphone to borrow money in between paychecks. Instead of running a credit check, the app will review your bank. Like DailyPay, EarnIn allows you to access funds you've already earned before your payday. Unlike DailyPay, EarnIn deducts your advance from your checking. Apply for an online payday loan today from Speedy Cash and get a lending decision in minutes. If approved, you could get INSTANT cash to your debit card.

Get a paycheck advance with early direct deposit when you need it, because life doesn't always wait for payday. Woman stands beneath an open white umbrella. A payday loan is a small, unsecured, high interest, short-term cash loan. In most cases, consumers write a post-dated, personal check for the advance amount. A typical payday loan involves the taking of a check and holding it for a few days or weeks (until “payday”), then depositing it or requiring repayment of the. We offer online Cash Advance loans in Canada. Apply today and borrow $ to $ in two hours with our easy application. What Is the Easiest App to Get a Cash Advance? Empower, with its free day trial, and Albert, with a one-month free trial, won't cost you anything if you pay. Get Payday Loans up to $ instantly from Cash 4 You. Apply online or visit the nearest Cash 4 You store to get a hassle-free payday loan. Reach us now! A cash advance is a small cash loan perfect for those that need a little help getting through till the next payday. No one enjoys living paycheck to paycheck—. Brigit: Best for financial management · $$ · business days · 20 minutes ; Empower: Best for small loan amounts · $$ · $8 · 1 business day ; EarnIn: Best. GET UP TO. $1, IN AS LITTLE AS. 30 MINUTES*. When you are in need of quick cash, Mr. Payday has got you covered! We have been helping canadians with their. As a result, you apply for another payday loan from a different lender. This vicious cycle continues until you're stuck with multiple loans, leaving you unable. Spotloan is a better way to borrow extra money. It's not a payday loan. It's an installment loan, which means you pay down the balance with each on-time. Now you can get personal loan offers from Brigit partners in the Earn & Save section on the app. - No one likes bugs, we fixed 'em! - Still got issues with the. They are intended to help consumers get some quick cash to hold them over until their next paycheck, hence the name “payday loan.” Payday loans are also. A typical payday loan involves the taking of a check and holding it for a few days or weeks (until “payday”), then depositing it or requiring repayment of the. A paycheck advance is getting paid your salary or wages, slightly before payday. It's important not to confuse a paycheck advance with a payday loan. A payday. Payday loans online at Check City are fast and secure. Apply in stores or online today with same day and instant funding options available. If you need cash before payday, it's easy and fast to get a loan with If your financial situation can't wait until payday, Advance America can help! The high cost of payday loans can eat away at your paychecks and make it likely The lender must put these and other terms of the loan in writing before you. With Bree, there are no mandatory fees or interest payments when you apply for a cash advance. You choose what you want to tip. This is a radical change from. Payday Loans · Yes, you can prepay the outstanding balance, at anytime without charge or penalty. · You may cancel a payday loan within 48 hours, excluding.

2 3 4 5 6